On 27 July 2017, the Resolution of the Cabinet of Ministers of Ukraine dated 4 July 2017 No. 480 ‘On approval of the list of types of business entities of non-residents who do not pay income tax (corporate tax), including foreign source income tax, and/or are not tax residents of the state in which they are registered as legal entities’ (hereinafter – the Resolution) entered into force.

From now on, tax legislation provides for a new criterion for recognizing transactions controlled. That is, all business transactions carried out after 27 July 2017 with non-resident counterparties of those types of business entities listed in the Resolution are deemed controlled if the cost criteria specified in subparagraph 39.2.1.7 of Art. 39 of the Tax Code of Ukraine are met. At the same time, the cost criteria for such transactions are calculated for the entire reporting (calendar) year.

On 14 August 2017, the State Fiscal Service of Ukraine (hereinafter – the SFS) published the Letter No. 21674/7/99-99-14-01-02-17 ‘On entering into force of the Resolution of the Cabinet of Ministers of Ukraine dated 4 July 2017 No. 480’ explaining the procedure for the application of the Resolution. In particular, the letter states that if a non-resident business entity of the types listed in the Resolution paid income tax (corporate tax) in the reporting year, the taxpayer's business transactions with such entity are considered uncontrolled absent other criteria specified in points ‘a’ – ‘c’ of subparagraph 39.2.1.1 of Art. 39 of the Tax Code of Ukraine. At the same time, SFS recommends obtaining a document that confirms the payment of income tax (corporate tax) by the non-resident counterparty. The Tax Code does not specify the form of such a document, a way of its receipt or its issuing body; however, the document must be certified and translated in accordance with Ukrainian legislation.

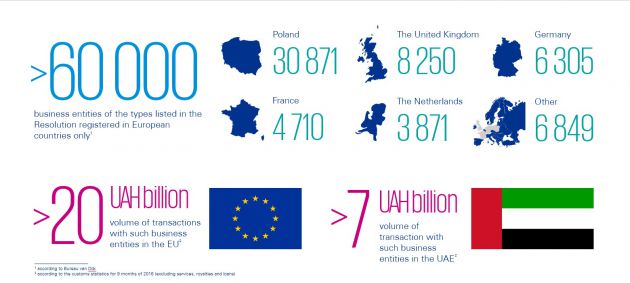

KPMG conducted a research to find out how the Resolution affects the business of Ukrainian companies. The research found the countries, the transactions with residents of which are highly likely to be deemed controlled at year-end 2017

Open the infographics

If you are not sure how the Resolution will affect your company, KPMG offers an algorithm, which will help you find out if the counterparty is on the List of business entities and whether the transaction with such a counterparty is considered controlled.

If you are not sure how the Resolution will affect your company, KPMG offers an algorithm, which will help you find out if the counterparty is on the List of business entities and whether the transaction with such a counterparty is considered controlled.

For algorithm, please contact KPMG in Ukraine, Denys Butylo dbutylo@kpmg.ua